Long Term Current and Past Portfolios

New Long Term Dividend Portfolios

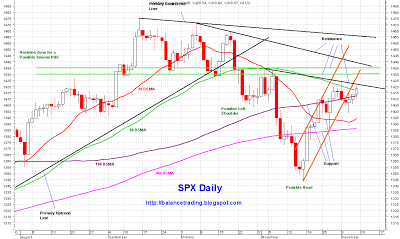

Last week SPX broke out of it down trending price channel (thick black) and started trading in a much steeper channel (thick orange). At this point chances are very good that SPX tests its 200 D-SMA around 1390 sometime this coming week, possibly tomorrow if no agreement is reached to avert "Fiscal Cliff". A close below 200 D-SMA would be extremely negative and would signal much more selling. My plan at this point is to exist my long positions. I think we are in for a nasty fight between Dems and Reps that will go on and on for a while, a long while.

Face Book

Disclaimer: The views expressed are provided for information purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.

Disclaimer: The views expressed are provided for information purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.

i

i