SGS Market Timer Status: SHORT

SHORT as of the close of Thursday April 6, 2023

Previous SGS Status

SGS is a Long-Term (weeks to months) Timer

SGS Performance Data

Why Market Timing Is A Must

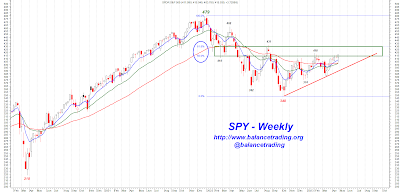

As of close last Friday, as shown above, SPY has retraced back more than half of its decline from its all-time high (479) to its low of last October (348). Despite the rally last week, under the hood things are rather bearish as SGS put in lower values.

At this point, one of the two following scenarios is going to happen:

(1) The boarder market rallies as SPY breaches its 50%-61.8% Fib resistance zone and SGS puts in higher values.

(2) Big market cap stocks sell off as SPY breaches its uptrend line (red), SGS puts in lower values, and indices sell off to test their October 2022 lows.

SGS Market Timer

As of the close of last Thursday (4/28), the value of SGS was calculated to be -168. The status of SGS remains SHORT.

S&P 500 Support And Resistance Levels

My Plan

No change, I'm 95% in cash and my plan is to stay in cash for now. Cash is earning around 4% at Fidelity.

twitter

opader@gmail.com

opader@gmail.com

SPX: S&P 500 Index SMA: Simple Moving Average

DJI: Dow Jones Industrial Index EMA: Exponential Moving Average

DJT: Dow Jones Transportation Index PDL: Primary Downtrend Line

NAZ: NASDAQ Composite Index PUL: Primary Uptrend Line

RUT: Russell 2000 Index ASL: Active Support Line

OEX: S&P 100 Index ARL: Active Resistance Line

NDX: NASDAQ 100 Index DTL: Dynamic Trend Line

TUL: Tentative Uptrend Line TDL: Tentative Downtrend Line

DJI: Dow Jones Industrial Index EMA: Exponential Moving Average

DJT: Dow Jones Transportation Index PDL: Primary Downtrend Line

NAZ: NASDAQ Composite Index PUL: Primary Uptrend Line

RUT: Russell 2000 Index ASL: Active Support Line

OEX: S&P 100 Index ARL: Active Resistance Line

NDX: NASDAQ 100 Index DTL: Dynamic Trend Line

TUL: Tentative Uptrend Line TDL: Tentative Downtrend Line

TLR: Trend Line Resistance TLS: Trend Line Support

Disclaimer: The views expressed are provided for informational purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.